As innovation drives automotive industry faster than ever, developing a strong patent portfolio will continue to remain a crucial business strategy. Patent Filings in some key whitespaces can give automotive players a competitive head start.

With stricter environmental regulations and ever-increasing oil prices, the automotive industry is rapidly moving towards Electric Vehicles (EVs). EV sales are also rising, as manufacturers strive to fulfill consumer asks of better driving range and reduced charging time.

Even as EVs gain momentum, there are still some concerns surrounding these vehicles. One major point of consideration is the safety aspect of EVs. EVs come with their own unique sets of safety hazards: they run using a high-voltage battery, have extensive electrical equipment, and pose a risk of battery chemical spillage which can catch fire.

In the last decade, there have been incidents where electric vehicles caught fire either spontaneously when they were parked or when they were involved in a crash. The first collision related fire was reported in China (2012), after a car crashed into a BYD taxi at a high speed. As the EV market has grown, there has been a corresponding sharp rise in such incidences. In 2018, a Tesla Model-S collided with a light pole causing the battery pack to ignite. In 2021, another Tesla caught fire after crashing into a tree.

To ensure safe roadways, regulatory authorities have developed a range of safety norms. Some protocols such as the Global Technical Regulations are followed by numerous countries (38 contracting parties including the EU, Japan, Russia). Some countries, meanwhile, have their own vehicle regulations. The U.S. follows Federal Motor Vehicle Safety Standards (FMVSS), Canada has Canada Motor Vehicle Safety Standards, and China follows Guobiao Standards.

For electric vehicles, safety regulations not only include the regular safety measures for conventional fuel vehicles, but also include EV specific aspects such as robust mechanisms to safeguard the high-voltage battery pack, prevent electrolyte spillage during a crash event, etc. In the U.S., the FMVSS defines these EV safety requirements. EV manufacturers strive to obtain these certifications, with some redesigning vehicle’s battery packs, modifying battery attachment techniques, and reinforcing electric isolations for improved shock protection. These changes are seeding new inventions. And yet, data suggest that patenting activity around these standards has barely begun – leaving tremendous untapped potential.

Developing a strong patent portfolio continues to remain a crucial business strategy for automotive companies. As auto giants identify ways to gain IP advantage – analyzing patent landscapes and discovering whitespaces is a definite recipe to win. Taking learnings from the communication industry w.r.t standard essential patents, this is a perfect opportunity for automotive players to build a strong patent portfolio around key areas of EV Safety Standards and gain a competitive edge.

But Why Are These Safety Standards Important?

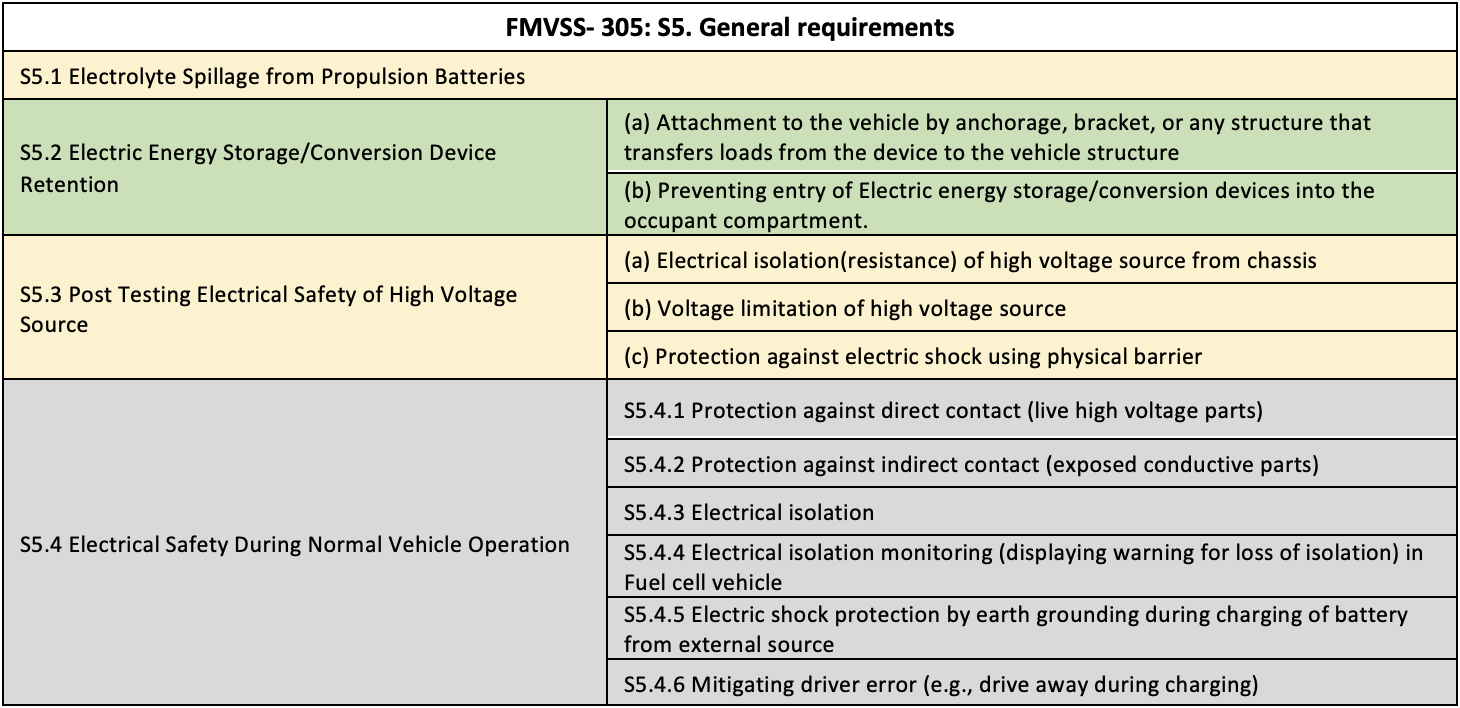

The FMVSS are U.S. federal regulations that specify minimum mandatory safety requirements for vehicles. Within FMVSS, 305 is the only standard that is specific to Electric Vehicle crash scenario safety. FMVSS-305 regulations define the after-crash safety requirements for EVs and are based around electrolyte spillage, retention of propulsion battery and isolation of high voltage systems for electrical shock protection of occupants and rescue workers. As these regulations are ‘mandatory’ safety requirements, all EV manufacturers need to ensure that their vehicles comply with these standards.

These regulations are divided into 4 broad categories and each category has more granular sub-clauses. Section S5.1 of FMVSS-305 defines the maximum limits of electrolyte that can spill within and outside the passenger compartment during an EV crash event. S5.2 lays down EV battery retention standards, and requires that even after a crash event, the EV battery should remain attached to the vehicle structure and should not ingress into the passenger compartment. S5.3 relates to electrical safety after a vehicle is subjected to a crash test scenario. Section S5.4 is focused on requirements for electrical safety during normal vehicle operations and relates to electrical isolation, shock protection, prevention of contact with high voltage sources, etc…

Where Do We Stand Now?

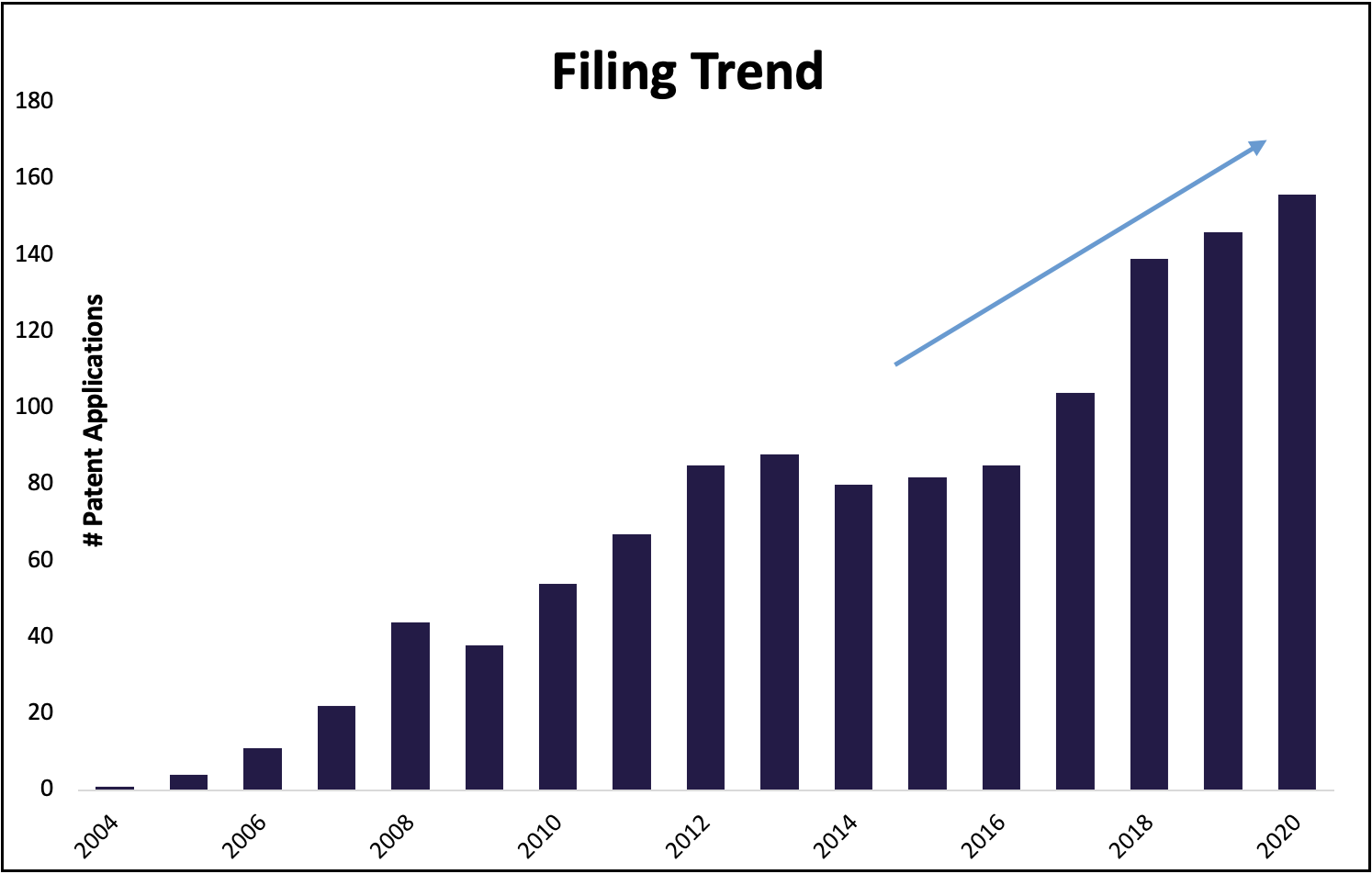

Patenting activity around various EV technologies is at full throttle with manufacturers like Ford, GM, Volkswagen, Toyota, Tesla, etc. building a strong patent portfolio. However, patent filings specific to various sections of FMVSS are still small.

The patenting activity related to sections of FMVSS-305 evidently picked up around 2008, where the emerging players were Ford, Toyota, and General Motors. The bulk of the filing started 2010 onwards with most their patents being filed in the U.S. jurisdiction. At present standing, the top filings have occurred in the field of Protection for Service disconnects (sub-section of S5.4.1), retention of the EV battery (S5.2(a)) and Degree of protection of High-Voltage parts.

Fig 1: Global Filing Trend Related to Sections of FMVSS-305

Taking the lead over others, the top patent filer in this domain (around FMVSS-305) is Ford. While the earliest filing of Ford was in 2003, most of their filing started from 2012 onwards. The focus of these patents was around secure attachment/retention of the EV battery and protection for service disconnects. Ford also filed some patents related to indication of active driving modes (subsection of S5.4.6) in the 2016-18 timeframe. Toyota follows Ford in this list, with the focus of their patents on improved battery protection during a crash event. Yazaki, a global auto-parts supplier based in Japan and General Motors are also amongst the list of prolific filers. Their filings are mainly related to visual depiction of high voltage cables and electrical isolation of high voltage sources. Further, companies such as BYD and Zhejiang Chilwee are also in this list.

Surprisingly, many leading EV manufacturers have only a handful of patents in this domain. Modern EV companies such as Tesla and Rivian and conventional players such as BMW and Volkswagen have not yet gained a key filer position around the FMVSS electric vehicle safety standards.

Fig 2: Top Patent Filers related to sections of FMVSS-305

Did You Miss This Patenting Race?

Patenting activity related to various sections of FMVSS-305 has started to pick up, but there is still a huge scope for EV companies to bag key patents around this mandatory safety standard. With increasing patent royalty charges and U.S. EV market projected to grow over 25% CAGR (Citation: Fortune Business Insights) by 2028, automotive players should not miss this chance to claim their IP dominance. However, a key question for EV manufacturers would be- where to start from for building a targeted portfolio in this domain.

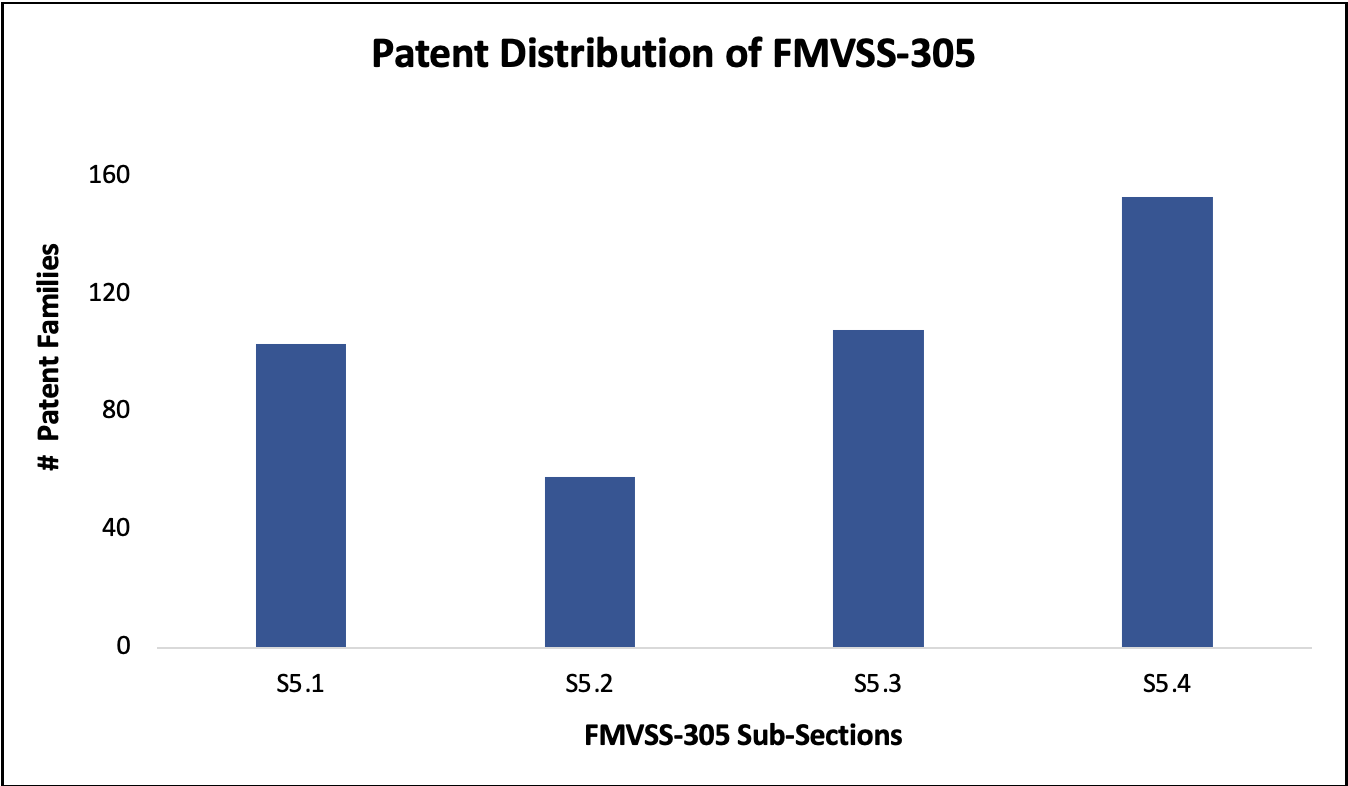

Fig 3: Global Patent Families Related to Sections of FMVSS-305

At present, there are several gaps (whitespaces) related to the FMVSS-305 safety standards where patenting activity is insignificant. For instance, only a small number of patents have been filed that related to post-crash minimization of electrolyte spillage from EV battery and improving safety from contact with high voltage parts in the passenger/luggage compartment. Moreover, while there are patent literatures related to retention of battery with vehicle structure, limited patent activity has been observed that specifically focuses on preventing EV battery from intruding into the vehicle compartment during a crash event. In these areas, further patents may be filed by the EV manufacturers to ensure comprehensive IP portfolio coverage and to gain a stronger position over competitors.